Automated Identity Verification

Identity verification method that’s as easy as snapping a picture. Simple for your users but extensive enough to prevent fraud and ensure regulatory compliance.

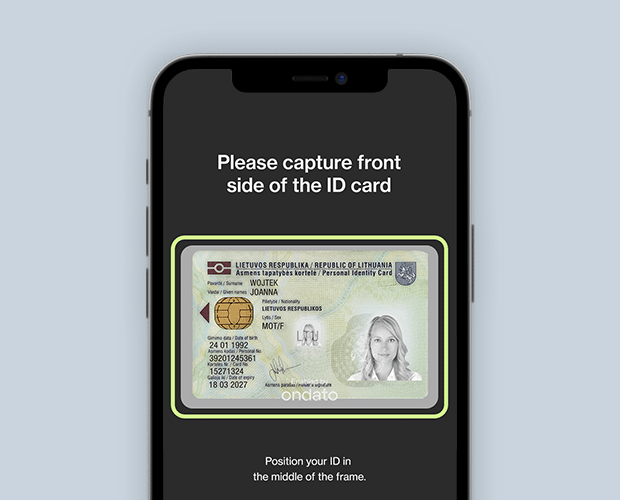

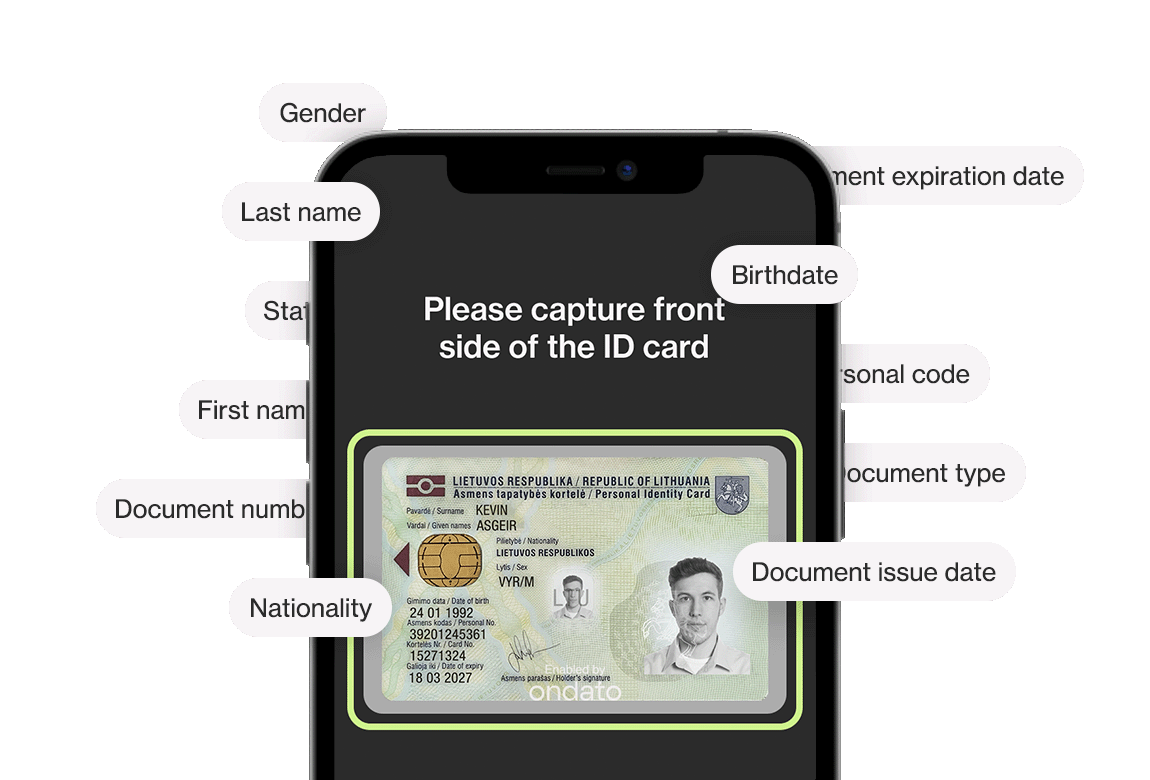

Identity Document Verification

Take a picture of one of 10,000+ different types of ID document worldwide and our system will pick up the necessary data to fill out the form. At the same time, the data will be checked against numerous ID registries to verify that it isn't stolen or altered in any way. Its authenticity is further assured by a final check provided by a human KYC specialist.

ID Spoofing Checks

Fake IDs aren't going to work. Ondato’s checks include multiple alteration filters and cross-references against ID registries.

Registry Confirmations

Quickly find out whether a document is valid and confirm if it hasn’t been altered in any way with local and international registry checks.

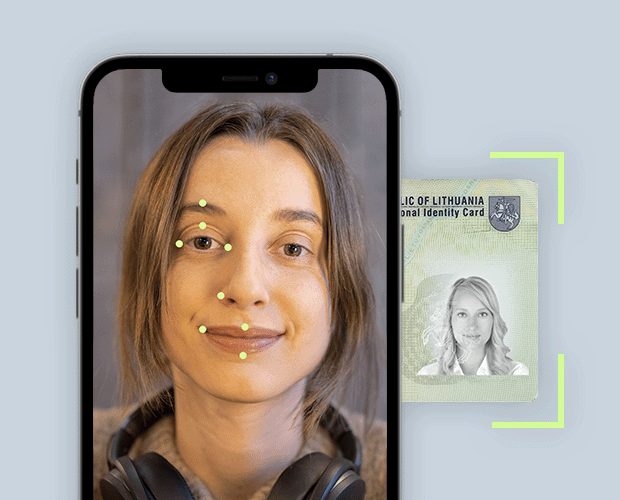

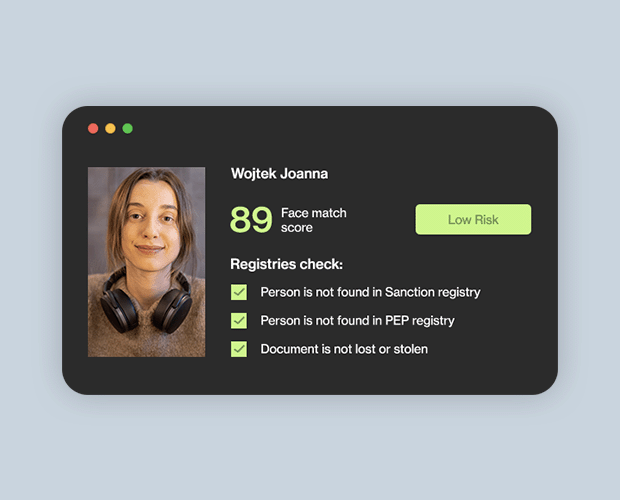

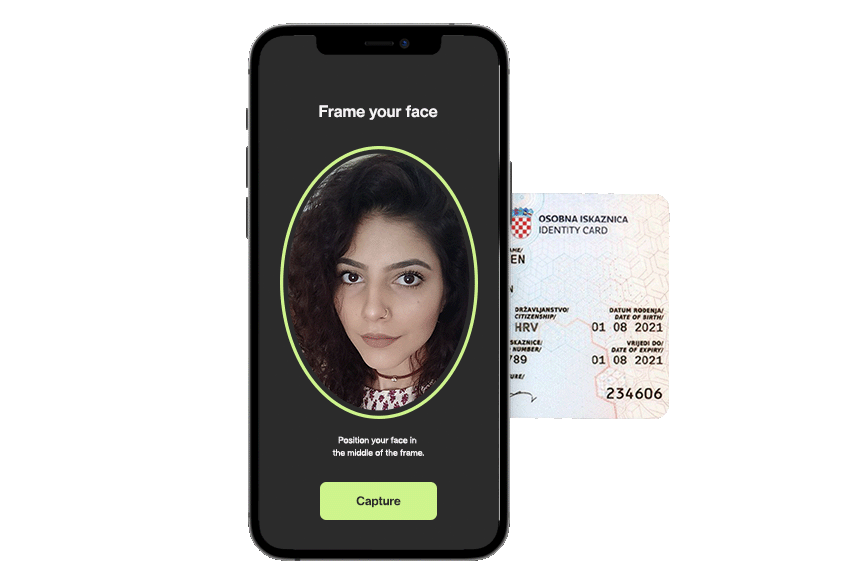

Face – A Universal ID

While faces are much more complex than documents, we're using technologies that make light work of recognition. Our system checks whether it's a real face or a mask. The checks can even include biometric age evaluation and comparing that to the data provided in a document.

Biometric Security

Unconscious faces, screens with deepfake video feed, and masks will be flagged and won't bypass our checks.

Biometric Face Comparison

We have tech that accurately compares ID documents with faces, filtering out identical twins and lookalikes to ensure the highest degree of accuracy.

Benefits

Next-Gen KYC Compliance

Management

Build Your Own Process

Mix and match our modules to create the perfect solution for your problems. Adapt the software to your unique business case, not the other way around.

Integrate with Customer Data Platforms

All our modules can be seamlessly integrated into customer data platforms. There you can manage cases and monitor customer actions after they've onboarded.