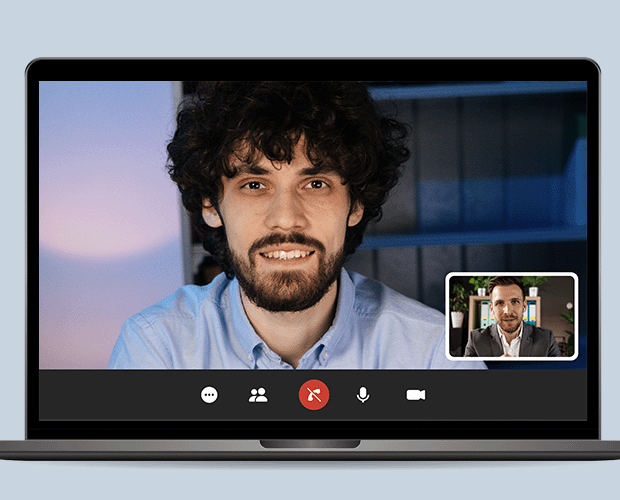

Assisted Identity Verification

Remotely verify your customers’ identity under the KYC agent’s supervision. Make your onboarding secure and compliant with all compliance requirements.

Real-Time ID and

Biometric Data Capture

Our assisted identity verification solution is real-time video calling that captures the customers' biometric and document data. The calls are encrypted to ensure the highest level of data security. This method allows KYC specialists to ask additional questions and build personal contact with the customer.

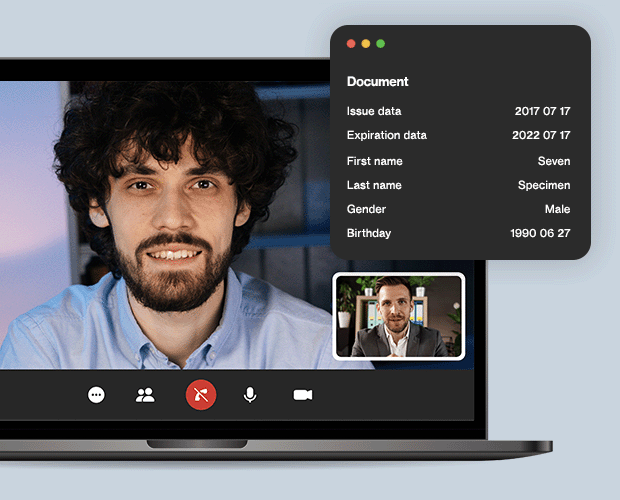

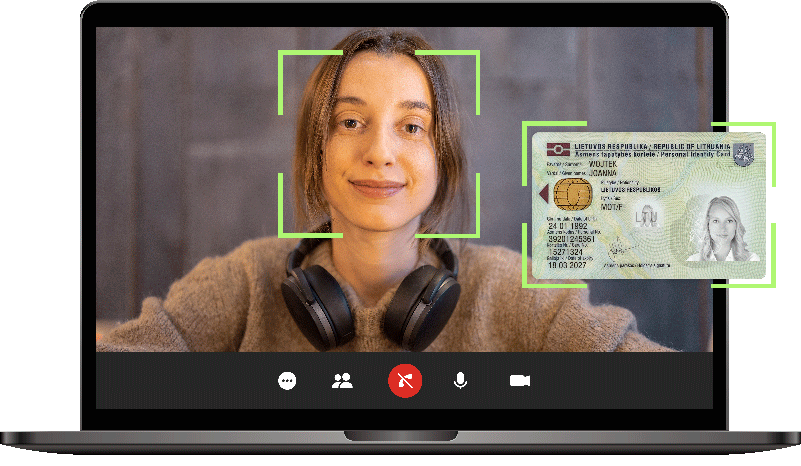

Pain-Free ID Verification

The only thing that your client will need to do is to lift their document near the camera. Everything else will be taken care of during the call.

Choose Your Agents

You have the freedom to use your own KYC agents and equip them with our suite. Or, if you prefer, you can fully outsource the checks and use agents provided by Ondato.

Extract Data Beyond

Document Retrieval

Empower your video calls with a capture mechanism that includes built-in spoofing checks. While your agent oversees the process, give them the tools to ensure that the used documents aren't altered or stolen. If you notice something odd, be in a position to react straight away.

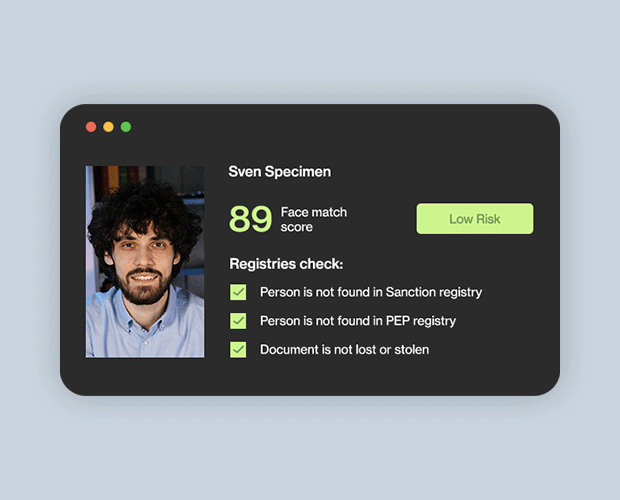

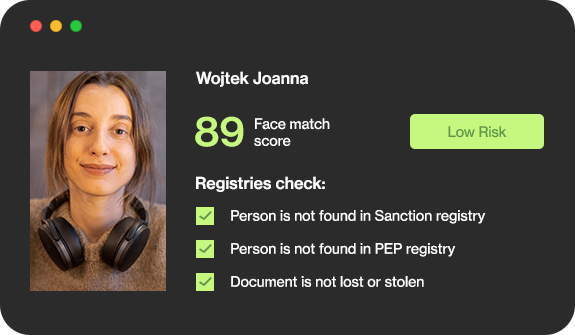

Instant ID Spoofing Checks

Sleeping faces, screens with deepfakes, and masks will be flagged and won't bypass our checks.

Registry Confirmations

Quickly find out whether the document is valid and not altered in any way with local and international registry checks.

Benefits

Next-Gen KYC Compliance

Management

Build Your Own Process

Mix and match our modules to create the perfect solution for your problems. Adapt the software to your unique business case, not the other way around.

Integrate with Customer Data Platforms

All our modules can be seamlessly integrated into customer data platforms. There you can manage cases and monitor customer actions after they've onboarded.