The Final Piece of the KYC Compliance Puzzle

We’re providing a comprehensive operating system for new client onboarding, user base management, intelligence and reporting that adapts to your unique business case. Using our modules, create a one-of-a-kind platform that solves your puzzles.

Solutions

What Is Ondato OS?

Ondato OS is a new approach to end-to-end KYC management. Pay only for the modules you use, but have a centralized platform for all your remote onboarding, existing customer database management, and reporting needs.

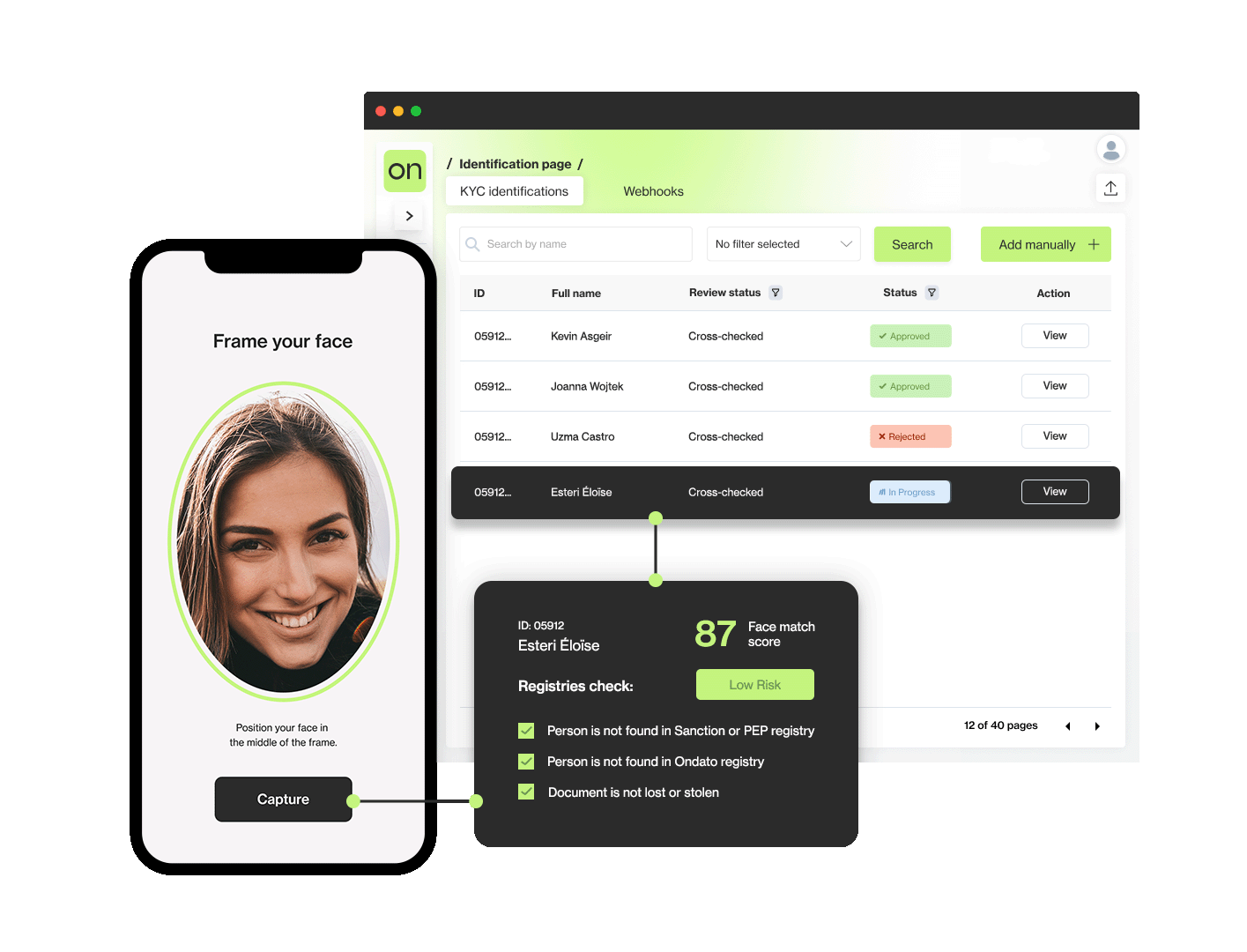

New Client Onboarding

Make sure that your new clients are what they claim to be. With digital identity verification for enterprises and individuals, we will ensure that your onboarding process is effective and fraud-proof.

Business Intelligence

Turn the data that you already have into a goldmine. Harness the power of AI to find valuable insights to improve your services with timely reports to always stay in the loop.

User Base Management

Manage your existing clients more easily and ensure they're in check with the latest KYB, KYC, AML, or CTF regulatory compliance requirements. From periodic monitoring to sanctions screening - never let your data go out of date.

Reporting

Keep track of all the changes within your client database at all times. If reasonable suspicion turns to probable cause, form instant reports and directly submit them to required institutions.

Key Benefits

One Dashboard, All the Tools

for KYC Compliance

Cut KYC-Related Business Costs up to 90%

Simplify Your Internal Processes and Save Time

Set Your Rules from Onboarding to Lifecycle Management

Stay Up-To-Date Regardless of Your Location or Regulatory Changes

Media Coverage

We Can Be Seen In

Statistics

Market Presence

192

Countries

10,000+

Kinds of Documents

60 sec.

60s

Average Onboarding Time

99,8%

Accuracy

Awards

Our Achievements

World Festival 2021

Innovation Award In AI and Machine

Learning Category

Innovation Award In AI and Machine

Learning Category

Fintech Week Lithuania

2020 Award For Fintech Enabler of the Year

2020 Award For Fintech Enabler of the Year

German-Lithuanian Business Fintech of the Year

Mastercard Lighthouse Program Finalist